If I Refinance My Paid Up Rental House Can I Start Depreciating It Again

The fact is that if there was one corking manner to unlock the cloak-and-dagger of how to go rich, we'd all exist doing it.

There are no "secrets" to getting wealthy overnight. But there areproven systems to become rich — and they accepttime. Let'south go into the steps you can get-go taking today to increase your income.

7 no-brainer steps to get rich (and some of them are faster than yous call up!)

Earlier you spring into footstep one, it'southward time to prep yourself and understand that what you think about coin might be wrong. Somehow, we manage to attach strange notions and thought processes to money that make it out to be something it's not.

We're going to walk you through some of those psychological traps and show you how to avoid them. Starting with your coin mindset.

Step #1: Your money mindset – Kickoff thinking like a rich person

Here's where you have got to go out of your ain mind and start evaluating the mode you think about money. Does it make you uncomfortable to think or talk about money, and if so, why?

I think visiting a friend who was housesitting her parents' house. This was the first time I'd been to the house and dare I say, it was exquisite. The parents definitely had some financial savvy. I was admiring their option of furnishings when my friend blurted out, "Oh I know the house is large, simply they worked very hard for their money." I remember wondering why she felt she needed to repent for her parents' wealth.

So what if they won information technology all at a horse race? Their money is their money! It'southward important to know that difficult piece of work doesn't e'er atomic number 82 to wealth. Anyone working a 10-hr shift in an Amazon warehouse will tell y'all that.

Just it highlights a social flaw. Anybody wants to be rich but those who already are certain as heck have to repent for information technology!

We're not going to exercise that anymore.

Mutual money mindset traps to avoid

The hustle trap:The more I work, the more I earn, right? Incorrect. You may be able to add together an extra hour of overtime to your workday or pick upward extra shifts, but at what toll? Living a rich life is also nigh your lifestyle. You'll want to set up your income sources then that you can earn coin in less time. Adding a passive income stream is a keen manner to exercise this, but exist warned – passive income notwithstanding requires up front work. But, it's way more constructive than picking up an hour or two of overtime every now and so.

The less I spend, the more I'll have:Technically that's probably truthful, but it also leads to a very dull life. While at that place is some merit to cutting dorsum on expenses, it's what you cut that matters. Cutting dorsum that $12.99 y'all spend on Netflix every month might seem similar a good outset, simply not if information technology'due south your but source of amusement.

Spending less on things yous beloved, for instance, that $3 Starbucks coffee, is not going to brand you lot rich. Information technology might increment your bank balance incrementally, but what about the quality of life?

What if you're but a picayune more conscious of the things you don't actually enjoy, and cut back on that instead? For case, finding a smaller flat at a better price because you lot spend too much time cleaning and also much money on heating. Frugality might accept a few merits and make you appreciate your resources, merely can besides zap the life right out of, well, life.

The goal is to spend less fourth dimension faffing over $three questions and more than time asking the $30,000 questions.

There isn't enough money out there:If yous've grown up in a household where there was a lack, it's possible that yous might attribute this quality to money also. Here's the affair though, rich people know that money is as bountiful as the sands on the shore. Adopting an abundance mindset volition help you realize that there's enough money to go around in the globe – even for you lot.

Footstep #ii: Pay off debt

Debt is expensive. Also, it affects your net worth. If your assets are worth $1 million, and your debt is at $700,000, your net worth isn't $1 million, it's only $300,000. Let's take a expect at what debt might mean for your finances.

- Mortgage:If you're looking to buy a $330,000 house with a $30,000 downpayment, y'all're nevertheless looking at a loan amount of $300,000. At an involvement rate of 3.8% per annum (which is considered low) and a term of 30 years, the total interest paid would be $203,233.94. Option that interest charge per unit up by a pct and you're looking at tens of thousands more than. If you have a mortgage, increment your installment and pay it off faster. Non just is there the satisfaction of owning an asset outright, but also that you're saving on involvement.

- Machine Loans:This is a quick debt trap that can bleed yous dry of potential. I say this because information technology'south so like shooting fish in a barrel to jump from a $30,000 automobile to a $lx,000 if the depository financial institution decides you tin beget it. But here's the thing: over the menses of 5 years at an interest rate of four.35%, you're looking at total interest paid of $three,434.fourscore vs $6,869.sixty. Imagine what nearly $three,500 can practise in a good investment product or to your retirement?

- Pupil Loans:Get rid of them, and quickly. Don't wait for the possibility that they might be forgiven. You demand to make headway on it every bit shortly equally possible or y'all'll still be paying off your student loans when your kids go to college. The quickest way to get this effigy downwards is to throw money at information technology. $50 extra per calendar month may not seem like much, but gradual increases like those go a long way.

- Credit Cards:Credit cards are swell if used well. The rule of thumb is non to use more than 30% of the available credit limit and to always pay your rest in full every calendar month. If you can't, you'll cease up paying very loftier interest with most cards. If you lot're stuck with a high residual, consider a 0% credit bill of fare and pay off the residuum earlier that interest-gratis period runs out.

Footstep #3: Invest your money (the smart way)

You're going to avoid the strange flyers in the postal service promising big returns on minimal investments into some company or scheme you lot've never heard of. Instead, you're going to larn about alphabetize funds, mutual funds, exchange-traded funds, and all the other types of investments out there and notice what works best for you.

If you're new to investing, allow us to introduce you lot to The Ladder of Personal Finance.

Each new rung on the Ladder is a level, and while they may increment in difficulty, they're non impossible to beat.

Read nearly the Ladder below, and as well check out this video where I hash out information technology on Skilful Morning America:

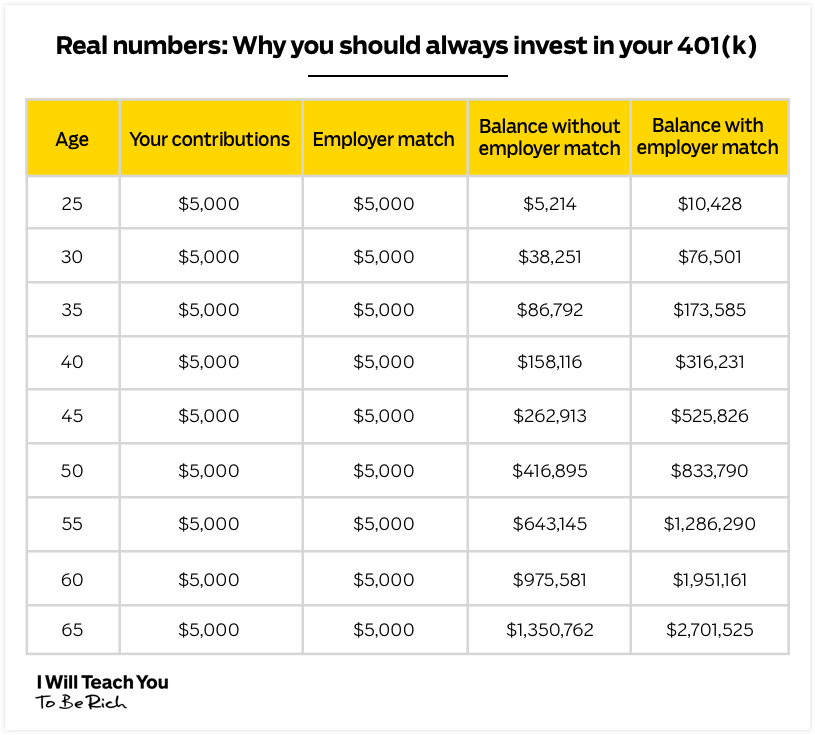

Rung One – 401(k)Optimize your employer's matched contributions if bachelor. Your 401(1000) is a means to a rich end, provided that you brand the investment try.

Rung 2 – DebtIf you still accept lingering debt, check out our methods to pay information technology off rapidly.

Rung 3 – Roth IRALike your 401k, you're going to want to max it out as much as possible. The corporeality you are immune to contribute goes upward occasionally. Currently y'all tin contribute up to $6000 each year.

Rung Four – Max Out Your 401(m)Retirement savings are cost-effective, given that accounts similar the 401(k) offer tax advantages. Before you invest anywhere else, make sure you make the most of these benefits.

Rung V – Other InvestmentsThis is where you diversify – after y'all've surpassed the other rungs on the ladder, rung five allows y'all to use actress coin for investing in common funds and other long-term options.

Bonus: Want to turn your dream of working from home into a reality? Download my Ultimate Guide to Working from Domicile to learn how to make working from home work for YOU.

Step #4: Automate your finances

At IWT, nosotros're large on automation, and with good reason. If yous work a typical nine-to-v and still want to have some decent family time or downtime, why on earth would you sacrifice part of that time to pay bills and exercise financial admin?

Your fourth dimension is valuable and thank you to technological advancements, yous get to keep more of that time for yourself.

You lot can prepare automated transfers for beak payments, savings, and investments. Then, after your automobile-payments are deducted, you tin can spend the rest of your money guilt-complimentary on whatever y'all want. Even items you lot might accept considered splurge items before. This is called a Conscious Spending Plan and it volition allow you more fiscal freedom than a budget ever will.

Pay yourself kickoff. This ways to save and invest before you go to Pottery Befouled's seasonal sale.

Pace #5: Earn more by negotiating your bacon

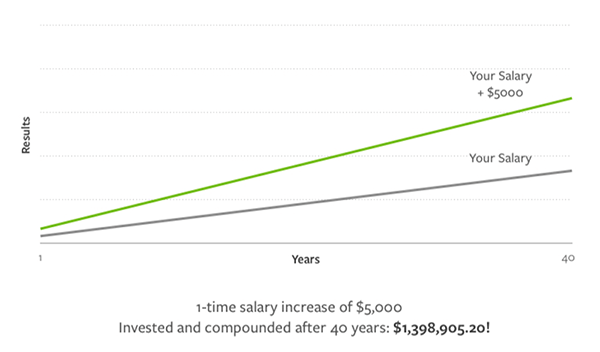

Getting a salary increase has the potential to crusade a ripple effect on all your hereafter earnings. More than income ways more retirement contributions and extra funds for investments and savings.

If this seems too proficient to be true and the mere thought of request your dominate for a enhance gives yous sweaty palms, we have the ultimate script for negotiating a raise.

Merely think nigh it, a one-time salary increment of $5,000 invested and compounded over a 40-yr period can be worth over $ane million!

Step #vi: Save money past negotiating your bills

If you accept a longstanding relationship with a provider, whether it's your local gym or a national banking company, you already have the leverage to negotiate your fees.

Other things that might count in your favor are competitors offering you a better bargain, you have a rocking credit score, or your provider makes a lot of money off the products y'all have with it.

Our founder, Ramit Sethi, jokingly tells us that he was bred to be able to negotiate thanks to his heritage and shares the fruit of those skills with us in his negotiation scripts. All you have to do is clear your pharynx, choice upward the phone and earn those extra dollars.

Footstep #7: Build multiple income streams

Something you need to know about the rich is that they always have more than one source of income. Whether it's passive income streams through investments, dividends or rental incomes, or returns on real manor, they hardly e'er rely on just a salary.

Boosted income streams can accept the form of:

- Side hustles such every bit blogging or photography

- Income from investments such as the stock market

- Starting a small business and condign cocky-employed

- Rental from an investment property, and more

The lesser line

Getting rich is not reserved for a select few out there. It's available to anyone who has the gumption to give it a get. Future y'all only has one ace in the bag, and it's the decisions y'all make today.

Instead of waiting for the proverbial ship to come in or cyberbanking your rich life on imaginary winnings, you lot can make small but enduring changes to your finances that volition shift your financial future. You deserve fiscal freedom.

Every great concern begins with a profitable idea. Later creating xviii+ successful products of our own, nosotros've adult a organisation that guarantees your business idea volition pay.

If you'd like to run across the system we've congenital — or if you only want to put your existing idea to the exam — enter your name and email beneath.

When you do, I'll transport you lot a costless video that shows you how to find a profitable concern idea in less than a week.

100% privacy. No games, no B.S., no spam. When you sign up, nosotros'll keep yous posted

If I Refinance My Paid Up Rental House Can I Start Depreciating It Again

Source: https://www.iwillteachyoutoberich.com/blog/3-proven-steps-anyone-can-take-to-become-rich/